Walk into your local cafe and ask for “a coffee”.

Give it a go and see what the reaction is. You’ll probably be met with a pause, then perhaps a polite “what kind of coffee?”.

If you ask what your options are, they may have a board up on the wall, a list to choose from. Now you have a list of options but it still doesn’t answer your question.

If you don’t know what you want, your barista probably steers you towards a latte. You don’t really know what you like until you’ve tried them out, but it’s quick, easy, and relatively cheap, with very few consequences.

Super funds feel a bit the same, except there are genuine consequences to getting it wrong and real benefits to getting it right.

If you’re employed, you need a super fund because by law your employer has to pay your super somewhere at least once a quarter. If you don’t choose, they will choose your fund for you, you will get one by default – a latte. It may be great, exactly what you want, but if you’re a piccolo sort of person, it may not.

It’s important to choose the right fund because super forms a big part of most of our financial futures. If you get one that’s too expensive or doesn’t give you the right options there are consequences, perhaps not immediately but you may find out when it’s too late.

It can be pretty daunting looking at the list of choices, but here are my top questions when considering a super fund:

Fees

There’s a lot of focus on fees and rightly so. There are some expensive funds around and while this isn’t make or break, the more you pay in unnecessary fees, the less there is left for you to support you in retirement.

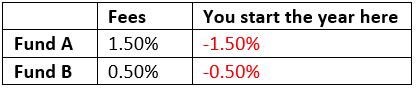

Fees are often charged irrespective of the end outcome for you, by way of example:

Fund A starts the year at -1.5%, it has to earn a 1.5% return before you are back to square one. Only after this do you start to grow your investment.

Fund B doesn’t have to go as far, only 0.5%.

Fees aren’t the be-all and end-all, but it’s important to know what you’re paying and what you’re getting for it.

Investment options

This one’s interesting, and you may skip this part altogether. Doing nothing often means you go into the default option (the latte). Be careful though, as you may find that the default doesn’t match what you want or need.

It’s worth considering what you’d like to invest in because it is your money.

Do you want investments that are ethical, or physical property? You might want shares in Google, Facebook and Amazon but not the big 4 banks and miners. If you want to be more involved then you’re going to have to choose a fund that allows you that flexibility.

Putting the 2 pieces together

Here we start to look at the sorts of funds available – we’ll cover this topic future posts, but as a rough rule of thumb the more a fund can do, the more expensive it is. Here you want to match up a fund that has the features that you’ll use at a reasonable cost. Don’t pay for options you’re not going to use. The classic example is opening your own super fund – an SMSF – and ending up with a term deposit.

Instead of right or wrong, think of the different funds as a good match for your needs or not.

It’s important to make an informed decision about where and how you invest your super. If you enjoy doing this sort of thing yourself, there’s plenty of great info available online.

If you don’t feel comfortable making the decision yourself if you’re looking for guidance on something so much more important than your morning coffee we’d love to help.

Feel free to DM, give us a ring, or book 15 mins straight into our calendar via the link below