Dealing with money can be daunting, confronting. As with other confronting things in life, they start as tiny little nagging doubts at the back of your mind, but they begin to snowball, between 2 am and 3 am seems to be an appropriate time for them to surface. They get big on us quickly, so big in fact that we can’t really face dealing with them.

The guy I look to for inspiration when I’m looking at something seemingly insurmountable is my father-in-law. A bit of background. He’s 76. He has 2 bionic hips, 2 bionic knees, a partly new ankle and probably needs a couple of new shoulders from decades as a shearer. If he can single-handedly run a rugged farm through drought, fire and flood – I can do (insert problem X).

How does this seemingly unflappable man do what he does? I’ve asked him, and his answer is “well mate, it’s pretty simple, same as eating an elephant, one bite at a time”.

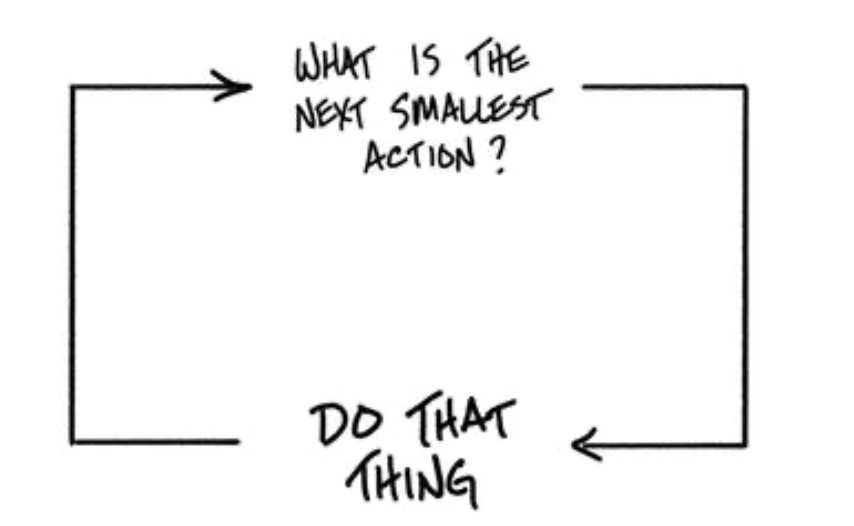

The picture above is from Carl Richard’s Behaviour Gap. It’s the same concept, perhaps a bit kinder to elephants.

A couple of examples:

Q. Which super fund should I choose?

Q. How do I choose a super fund?

Step 1. Start with why it’s bothering you.

Are you worried that you don’t have enough investment choice, aren’t getting a good right return or you want to pay less in fees? Perhaps under all of that you’re just worried you don’t have enough.

Step 2. Research.

Now you know what’s bothering you, you can take the next step – research. It might be reading up to give yourself more knowledge – enough to solve it yourself.

Read about “how much do I need, how much is enough”.

Do you want to be actively involved with investment decisions, or just know that it’s under control? Do you want a low-cost no-frills option or something with bells and whistles?

If you can’t solve it yourself with confidence, don’t stop now, seek out guidance and advice from someone who can solve it for you.

Step 3. Take action.

Make the changes you want to make, or book the meeting with the person who can help you

Q. Do I need life insurance or income protection?

Q. How much insurance do I need?

Step 1. Start with why it’s bothering you.

Everyone else has it. Are you worried that your death could leave your family with a mortgage and no way to pay it? Are you worried if you couldn’t work (through illness or injury) you have to sell your home?

Step 2. Research.

Now you know what’s bothering you, you can take the next step – research. It might be reading up to give yourself more knowledge – enough to solve it yourself.

Read about the different types of insurance. Read about different ways to pay for it so that it’s tax effective and ties in to your will.

Do you want to read each line of the policy document, pick each feature, calculate the amount you need and allow for tax?

If you can’t solve it yourself with confidence, don’t stop now, seek out guidance and advice from someone who can solve it for you.

Step 3. Take action.

Make the changes you want to make, or book the meeting with the person who can help you.

No matter the problem, there is a way forward – even if it’s not always palatable. The sooner you take that next step, the better