What is diversification?

Investopedia.com defines diversification as “a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single asset or risk”.

Put simply, diversification is a way to invest more safely. Diversification helps reduce the risk of losing the money you’ve invested without significantly reducing your returns.

What are the chances?

Vanguards’ Burton Malkiel wrote, the investment classic “A random walk down Wall Street” in 1973. The fact that it’s still being printed nearly 50 years later, tells us that it’s got real merit. The “random walk” but in the title refers to the random nature of investment markets. What do we mean by random? The chance of your investment going up tomorrow is 50/50 – the same as a coin toss, a bet. To illustrate the impact of diversification let’s follow through with the coin toss analogy.

Take a “portfolio” which contains a single investment, represented by a single coin. Your result depends on that single investments’ return, you’re either up or down.

Now add another four coins to the first one. The chance of that first coin being up or down remain 50/50, but it’s impact on the overall portfolio result is reduced, it’s only 1 of 5 coins.

Extend that analogy and lets add more coins into the mix to replicate a fully diversified portfolio. Now that first lone coin becomes one of perhaps 1,000. How big an impact will that single coin being up or down have now? Though it will still influence the portfolios return, the impact is muted because you have spread the risk and diversified.

The good news is that with more investments and more time comes additional certainty. You probably know this already. As a basket of investments, a managed fund or ETF has a level of diversification built in. It’s worth digging a little deeper into diversification and a range of significant, often hidden risks and how to reduce them.

Concentrate

As an adviser one of the first things I do whether building or reviewing a portfolio is to look for concentration. Why? Concentration means risk. You are likely familiar and comfortable with allocation across asset classes – Aussie shares, international shares, property, bonds and cash, but it’s crucial to consider diversification within asset classes.

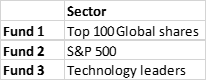

Here’s a quick example – 3 large, liquid, ETFs to cover the international shares allocation in your portfolio.

These funds hold plenty of companies across different countries. Does that make it well diversified? Before we answer that, let’s look at the makeup of those funds based on geography and stock overlap.

Fund 1 invests in global leaders – large and giant cap companies as we’d expect from the label. The majority of these companies are based in the US.

Fund 2 invests in the S&P 500 index – large and giant cap companies. These companies are all based in the US

Fund 3 Technology leaders – mostly large cap companies, but we do start to see the introduction of mid caps in this fund. Unsurprisingly, heavily invested in the US.

Geography

If these were bought in equal weights, the allocation to the US is a little over 82%.

Buying the same thing more than once

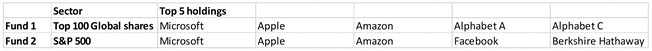

Here’s where good quality research and research tools are crucial if you’re going to understand what each fund holds and to what degree.

The top 5 holdings are looking remarkably similar

Looking deeper than the top 5. Two names, Microsoft and Intel sit in all three funds. Microsoft is in the top 10 holdings of each fund. Outside of that, a further forty eight names sit in two of the three funds.

If we now take a critical look at the international allocation in your portfolio, it is almost entirely focused on large and giant cap US equities, with around half in tech stocks.

Geographically, you’ve missed opportunities in Asia, Europe and Latin America.

You have a small allocation to the up and coming businesses – the next Google or Apple or Tesla, but you get them once a big chunk of the growth has happened – you don’t have the chance to invest in them when they’re young up and coming growth stories, brilliant ideas looking for capital to help them grow.

How do you feel about the diversification in your own portfolio?

Diversification is a conscious spread of risks across countries and regions, companies and industries. Instead of picking individual investments in isolation, take the time to understand what’s under the hood.

OK, now what?

If you don’t have the time, tools or expertise to do this yourself, take the time to find an adviser who does. Find an adviser who will talk you through what investments are in your portfolio, why each has been selected. This means the heavy lifting is done for you and you can invest secure in the knowledge that you’re in a position to make more money with less risk.

Wondering where you can find just such an adviser?

Click on the “start here” button on the main page, or here… https://buff.ly/3sFHIJl